Pollen Experiences was once considered one of the most innovative companies in travel, live music and fan-to-fan marketing, but this week, officials announced that its U.K.-based parent company, Streetteam Software Ltd., was preparing to undergo restructuring — a voluntary process similar to filing chapter 11 bankruptcy in the U.S.

The news is a stunning fall from grace for a company widely regarded as the largest of its kind in the travel and music space. In April, the company’s founders Callum Negus-Fancey (the company’s CEO) his brother Liam Negus-Fancey and company president James Ellis announced that they had raised $150 million in a Series C funding from six well-known venture capital funds, bringing total funds raised by the company to an astonishing $250 million. Much of the April funding had closed back in December and included the conversion of two convertible loan notes raised throughout the previous 18 months to help fund the business through COVID-19 and venture debt funding.

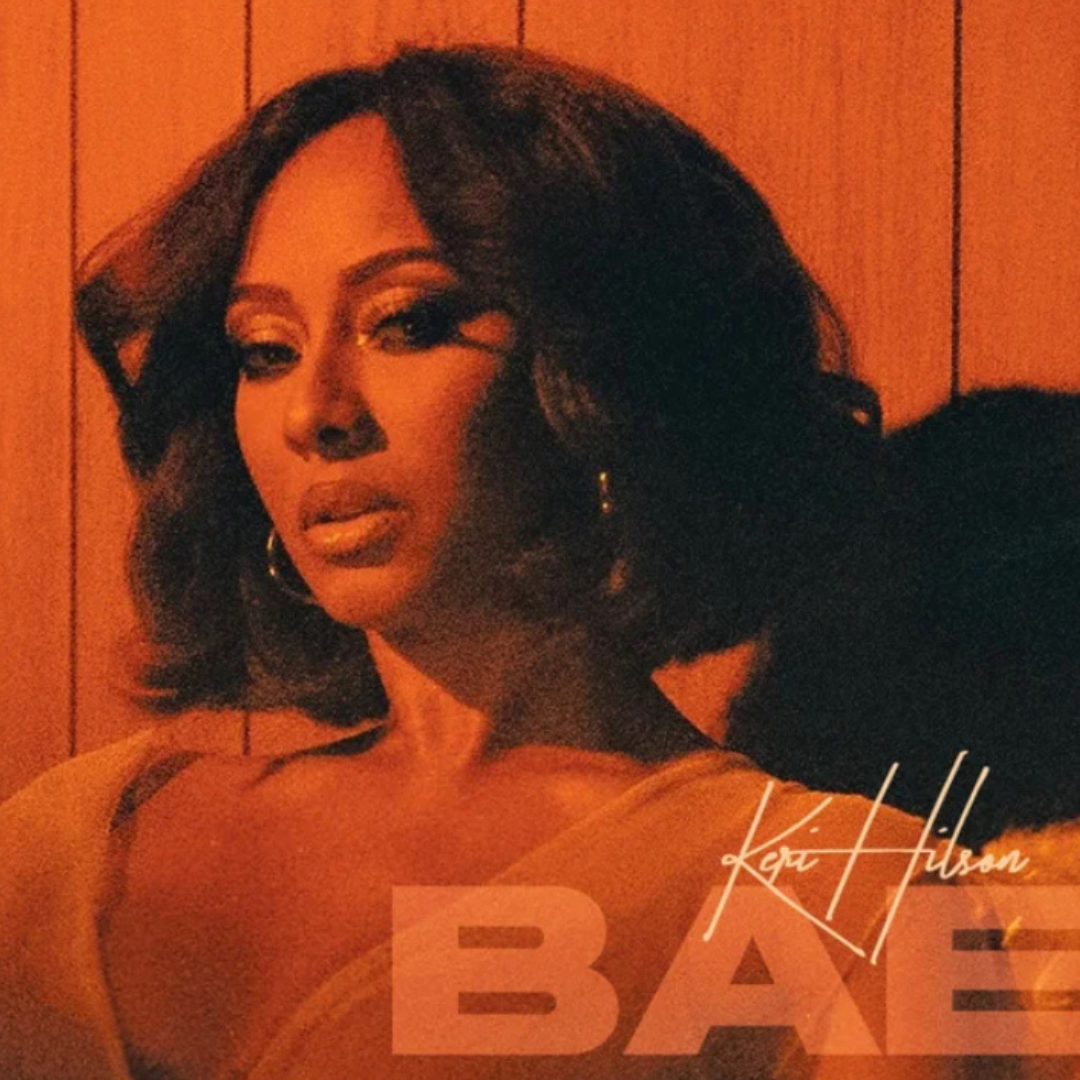

The April announcement was supposed to demonstrate financial stability for Pollen, which works with hundreds of artists including Justin Bieber and Duran Duran, as well as J Balvin, who partnered with the company on his NEON festival series.

But behind the walls of Pollen’s LA headquarters, life inside the company was getting more chaotic. One former employee, Joshua Fakhri, said that in 2019 and 2020 at least 10 “employees were each personally given $10,000 in cash and instructed to fly to Mexico without declaring it, as a way to structure…outbound cashflows” for JusCollege, a travel company Pollen acquired in 2018, and “evade United States and Mexico customs officials,” according to a civil complaint filed in LA Superior court on Oct. 10, 2020, alleging that “this cash was then used in Mexico to pay vendors owed money by JusCollege.”

Fakhri also alleges that “in 2019, Streetteam threw a company retreat in Northern California, where numerous executives and employees consumed copious amounts of illegal drugs, including acid and mushrooms. The debauchery was so extreme, the venue blacklisted the company from ever returning,” according to the complaint written by Fakhri’s lawyer Marc Gans.

Other lawsuits filed against Streetteam and Pollen show that the company faced constant liquidity issues. On May 4 — less than four weeks after the April funding round was announced — members of the company’s board of directors began exiting the company, starting with Pär-Jörgen Pärson, whose Swedish venture firm Northzone had led a $60 million initial cash raise for Pollen in 2019. That same day, Nicola Mcclafferty with Irish venture fund Molten also resigned from the board. By June 30, Pollen’s eight-member board was down to three people — Ellis and the Negus-Fancey brothers.

On July 7, the company released a statement saying it was abandoning its growth-at-all-costs model to focus on short-term profitability.

“For more than a decade startups have been built on the principle that growth is the biggest driver of valuation and is more important than anything else, however, this principle is not holding true today,” the statement reads. Citing inflation, skyrocketing energy prices and the rising costs of living, the statement noted a shift in investor mentality as they look for more than just growth, instead wanting to see businesses that have strong earning potential and profitability.

On July 18, Streetteam filed its annual report for 2021, showing the company’s losses were on the rise, ending the year more than $61 million in the red. That was up 27 percent over 2020 when the company posted losses of approximately $48 million, according to financial documents. The losses were likely due to skyrocketing costs — up 76 percent year-over-year.

Despite those losses, the report’s balance sheet showed that the company had ended the year with approximately $16 million in the bank, with Ellis noting “the group’s liquidity is sufficient to meet the group and parent company’s obligations and committments” through Dec. 2023. The company’s auditor, Philip Westerman with accounting firm Buzzacott, agreed with Ellin’s assessment, declaring that the financial report provided a “true and fair view of the state of the parent company’s affairs” through the end of 2021.

Just 22 days later, the company would announce that it had hired insolvency specialists Kroll to administer its debt restructuring while it continued to negotiate with a potential buyer. Accompanying the announcement was a statement that was much less rosy than the company’s 2021 report, blaming the restructuring effort on the “knock-on effects of COVID-19 over the last two years, which decimated much of the travel sector, together with the tech stock crash and current consumer uncertainty in light of global economic conditions.”

The company’s own financial statements, along with 10 lawsuits filed against Pollen and Streetteam since 2020, show it has long faced cash flow challenges, often missing deadlines from outside vendors for payment. A spokesperson for Pollen told Billboard that 10 lawsuits “is not unusual for a company of our scale and we do not comment on ongoing legal matters.”

Pollen was launched by the Negus-Fancey brothers in 2014 as Verve; it received U.K. taxpayer support through the British Business Bank’s Future Fund. It was originally conceived as a technology company built around influencer and word-of-mouth marketing to help promoters sell tickets for festivals and events. Early supporters included Gareth Jefferies, investment manager at Northzone, an early investor in Spotify, who saw the company as a potential sales tool for brands to connect with Generation Z customers and capture part of the $800 billion that 16–28-year-olds in the U.S. spend annually. In 2018, Verve began acquiring travel and tour companies like JusCollege and Campus Vacations; a year later, it received a $60 million cash infusion from Northzone and European VC Sienna Capital and changed its name to Pollen. At its height in 2019, the company had a network of 35,000 active member sellers who sold 330,000 music and travel experiences to their peers, partnering with brands like Live Nation, MGM Resorts, TAO, Hakkasan and AEG.

Pollen was hit hard by the COVID-19 pandemic in 2020 and took drastic steps to reduce its workforce, according to Fakhri, a regional manager hired at Pollen in 2018. Fakhri alleges that the company didn’t realize it owed him a $100,000 severance payment when it laid him off in early April 2020. When he inquired about it in writing to company officials, they allegedly attempted to rescind the layoff and then fire Fakhri for cause three weeks later to avoid paying out any severance. Fakhri eventually settled with Pollen but took the company back to court after it missed a deadline to wire him a scheduled payment of $25,000 in February.

A female executive assistant who quit the company in January 2021 sued in LA Superior Court four months later, alleging she was subjected to “unwelcomed touching” and that an executive at the company “sent her a picture of his naked erect penis by text message,” according to the civil complaint. The employee said she was retaliated against when she complained.

Additionally, a software firm subleasing office space from Pollen at its LA headquarters sued the company after it learned that Pollen officials had not turned over rent payments to the building’s master landlord. It also tried to get a court order preventing Pollen from drawing down from a bank account containing $222,000 that was meant to serve as a safety deposit. Beginning in 2022, Pollen also faced a series of lawsuits from vendors who alleged the company had not paid for various services it had contracted to receive. In July, Pollen was sued by the Swimming Swan lifeguard company in San Diego County Court over an unpaid $44,000 bill.

That complaint, written by attorney William Browning, alleges Pollen “has a history of promising to pay vendors and contractors for goods and services and failing to do so. POLLEN similarly sells tickets to events, but when the events are cancelled or rescheduled, POLLEN fails and refuses to provide refunds despite the express promises it makes before ticket purchase and after cancellation, to promptly refund customers. Upon information and belief, plaintiff believes that Pollen’s modus operandi is to put on events based upon promises to pay vendors and contractors, without the ability to pay those vendors and contractors, and with no reasonable belief that those vendors and contractors will be paid upon the agreed terms.”

In a separate dispute with vendor HADCO Staffing Solutions over an unpaid bill of $22,000, Pollen agreed to make eight payments of $3,700 a month beginning July 1, 2022. But when it came time to make the first payment, Pollen officials let the deadline pass and didn’t return phone calls from HADCO executives inquiring about the whereabouts of the money.

Days later, HADCO filed suit.